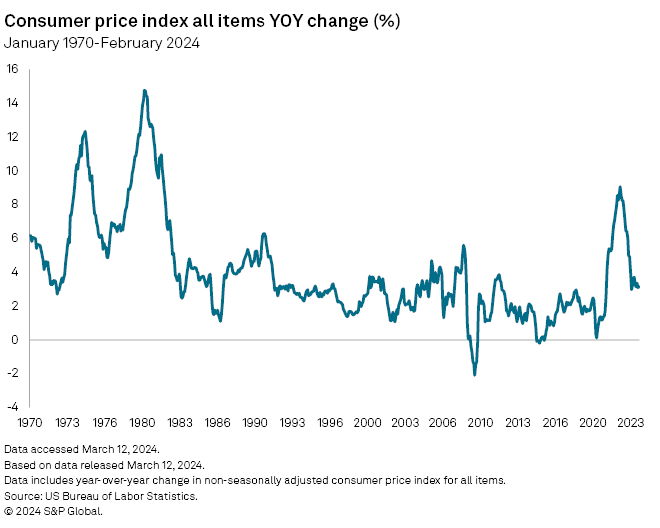

As Inflation Remains Over 50% Higher Than Fed Target Hope Diminishes For Near Term Rate Cuts

Standards and Poors Global Intelligence reports that as the consumer price index and other key measures of inflation remain stubbornly more than 50% higher than the Federal Reserve’s established annual target rate of 2% bonds and other market bets relying on future Fed rate cuts are suffering.

The Consumer Price Index for February 2024 showed a 3.17% increase in consumer prices across the board led largely by increases in housing related costs. That was up from the January 2024 CPI increase of 3.11% and marks nearly 3 unbroken years of monthly inflation measures over the Fed rate target of 2%.

As a result, investment market bets on rate cuts are suffering as inflation continues to tick along above the 3% annual range month after month.

Inflation is one of the key drivers of a number of negative or at the very least challenging economic decisions from expanding operations to making large scale purchases, so we track it very closely at the Association of Wester Employers.

Check back often for more analysis and news on emerging trends and news driving the long term development of employment especially in the West.

The Association of Western Employers is dedicated to helping employers of all types to create career building job opportunities while helping employees develop those careers because every American deserves the opportunity for a great career.