Consumer Goods Lead Inflation To Near Historic Peak of 7.5%

Inflation, which in 2021 showed up both in durable assets and consumer prices, over the last month was led by consumer price inflation according to the national Labor Department.

While the traditional response to price inflation is painful patience to see if it is transitory, follow if necessary by more painful rate hikes by the Federal Reserve, complex debt arrangements across the economy, including in many sectors that produce consumer goods, that are tied to extremely low interest rates will complicate the Fed and policy makers have going forward.

In other words, setting out to calm price inflation by curing overborrowing may actual constrict supply of the goods driving the price inflation… which in turn could create more inflation or deeper economic challenges…

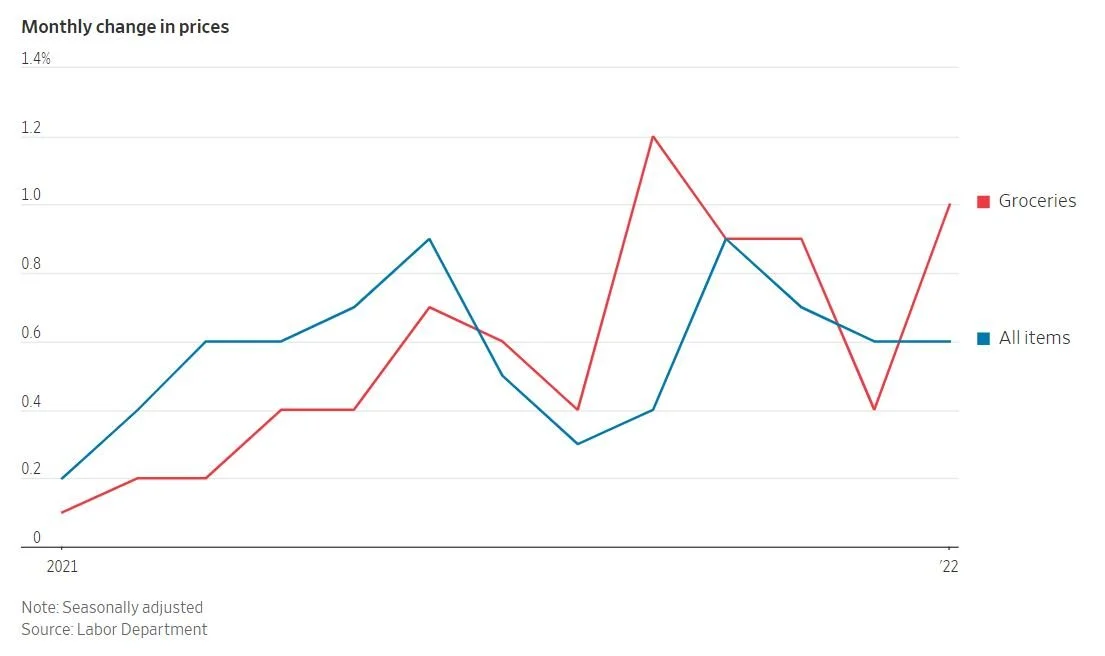

As pointed out in the chart above, while other consumer goods, including used cars, travel related expenses, and energy drove inflation during 2021, groceries began to outpace and ultimately drive inflation increases in the last 60 days.

We will continue to track this story as it develops…