America Experiences A Stagflationary First Quarter For 2022

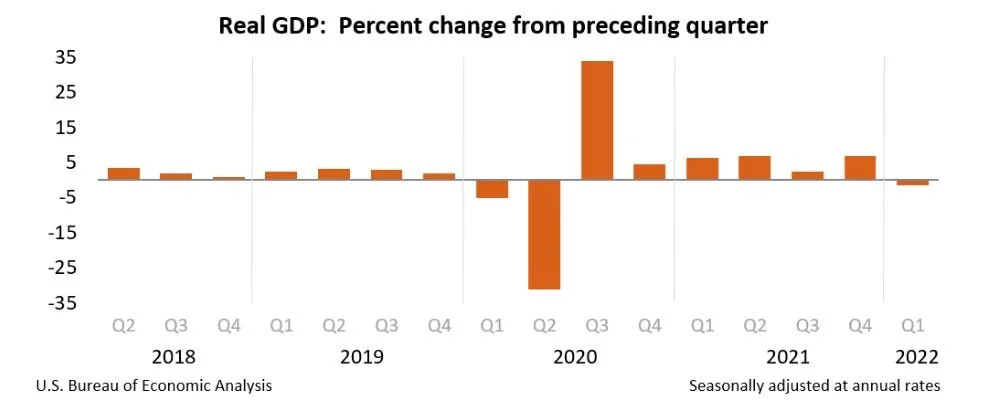

Facing heavy inflationary headwind, the American economy in the first quarter of 2022 experienced a contraction of 1.4% in real Gross Domestic Product.

May be too early to call a recession but what we just lived through is stagflation where a stagnant economy still produces high inflation.

As we have reported throughout the quarter and last year, inflation historically and especially the necessary Fed activity to control inflation when it rises significantly above the 2% target invariably has led to a contraction in the economy.

In this case, the decline in economic activity was felt largely before the Fed’s increase of one-quarter point (25 basis points), so it is clear that:

The economy is not in a growth driven ‘overheated’ inflationary model as many had claimed which normally is controlled by consistent, drumbeat style Fed tightenings that are designed to discourage speculative investment, etc.

The economy possibly could be looking at a ‘stagflation’ moment where inflation is rising quickly and economic growth soft, inconsistent, non-existent, or negative, which over the last quarter clearly it was non-existent.

While it is too early to diagnose a ‘stagflation’ economy like that that plagued to high inflation periods throughout the 1970’s and into 1981 when the Fed aggressively raised interest rates for a relatively short but extremely painful recession, this chart and reporting by the national Bureau of Economic Analysis seem to be pointing to that being a distinct and distasteful possibility.

We will continue to report on this issue and the impact on employers across the American economy.

The Association of Western Employers is dedicated to helping employers of all types to create career building job opportunities while helping employees develop those careers because every American deserves the opportunity for a great career.